Digital transformation has disrupted almost every industry, including supply chain finance. With its invoice processing efficiency and transparent transactions, blockchain technology has shown great potential in shifting the existing supply chain finance solutions during the past few years.

Also, in light of the novel coronavirus outbreak, enterprises have begun to face steep financing challenges. However, blockchain technology’s traceable and transparent nature has established trust for all parties involved in supply chain financing. Several significant pain points in the financing process have diminished due to this technology. With the advent of many companies already adopting blockchain technology in their financial solutions and solving financing issues, many more have begun to follow suit.

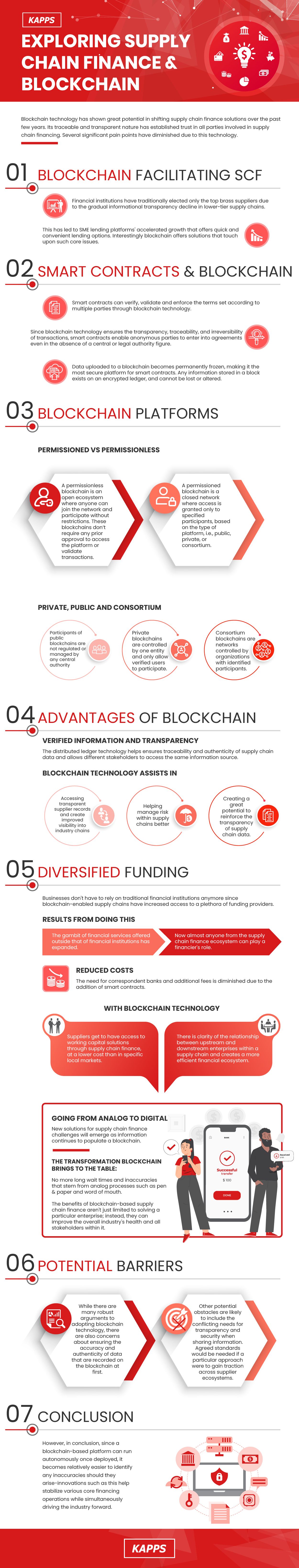

How does blockchain facilitate Supply Chain Finance?

Financial institutions have traditionally elected only the top brass suppliers due to the gradual informational transparency decline in lower-tier supply chains. This has led to SME lending platforms’ accelerated growth that offers quick and convenient lending options. Interestingly, blockchain offers solutions that touch upon such core issues.

Smart Contracts, for instance, are one of the most important applications of blockchain for trade. They are contracts that can self-execute based on buyer-supplier agreement terms that are pre-written into the code.

What is a Smart Contract?

A smart contract is a protocol that uses blockchain technology to execute and enforce the terms and conditions of an agreement.

The involved parties can enter into a blockchain-powered smart contract by first, negotiating and agreeing upon the terms and conditions of the agreement, which are then wholly or partially embedded into the smart contract code within the blockchain.

By running on a decentralized network, smart contracts eliminate the need for intermediaries to authenticate deals. They offer a more trusted method of conducting transactions without the involvement of unknown third parties.

Smart contracts automatically perform tasks based on the specified set of instructions when the contractual terms and conditions are fulfilled.

Smart Contracts and Blockchain

Smart contracts can verify, validate and enforce the terms set according to multiple parties through blockchain technology.

Since blockchain technology ensures the transparency, traceability, and irreversibility of transactions, smart contracts enable anonymous parties to enter into agreements even in the absence of a central or legal authority figure.

Data uploaded to a blockchain becomes permanently frozen, making it the most secure platform for smart contracts. Any information stored in a block exists on an encrypted ledger, and cannot be lost or altered.

Types of Blockchain Platforms

Blockchain networks exist in multiple forms depending on their varying properties like participant identities, the extent of decentralization, consensus protocols, energy consumption, privacy levels, speed, and scalability.

The two most common classifications are public and private blockchains, with the latter consisting of a partially decentralized sub-network called consortium or federated blockchain. Some experts in the field, such as Vitalik Buterin in his 2015 article On Public and Private Blockchains, even regard consortium blockchains as an independent blockchain.

Other well-known classifications of blockchain applications include permissionless versus permissioned platforms, which determine the level of access and the restrictions placed on those with permission.

Both categories are often confused together, with many mistaking public blockchains for permissionless blockchains, and private/consortium blockchains for permissioned blockchains. However, this is untrue, as public blockchains could also be permissioned.

Since blockchain as a concept is complex, fast-paced, and ever-evolving, definitions and classifications may still be hazy sometimes. As financial technology keeps advancing, futuristic models of transaction flows and applications continue to emerge, along with improved definitions and distinct classifications.

Here are some of the most popular blockchain platforms that offer financial services under these three blockchain models.

Smart contracts, which are programmable contracts with automated executions, are designed to minimize transaction costs offer possibilities that play a distinct role in the implementation of blockchain. By automating financial processes such as client order submissions, smart contracts vastly improve the quality of contract-based services like loans and insurance. And since it offers a fully traceable and transparent mode of transaction, Smart Contracts instill greater trust among the involved parties, held strictly to their payment obligations. According to Market Research Future, the Smart Contracts market has been forecast to grow to approx. $300 million globally, by the end of 2023.

Stellar

Stellar is a decentralized, distributed ledger network that can facilitate transactions between any type of cryptocurrency. Much like Ripple, another blockchain-based payment network, Stellar also facilitates exchanges between cryptocurrencies and fiat currencies. Stellar enables you to build banking tools, smart devices, and mobile wallets.

Stellar Consensus Protocol (SCP) executes consensus protocol without relying on a closed-loop design to store transaction data. SCP offers a set of provable safety properties which optimizes for safety over liveness. In case there are misbehaving nodes or partitions, the SCP holds off on progressing the network until it achieves consensus.

By requiring less financial and computing power than the proof of work and proof of stake algorithms, the SCP lowers entry barriers and encourages more participation from new entities.

SureRemit, a non-cash remittance service provider, uses Stellar blockchain technology to facilitate cross-border money transfers between various parties through its merchant network. ICICI Bank, NaoBTC, RippleFox, Tempo Money Transfer, and Flutterwave are other companies that have implemented Stellar technology to enable cross-border funds transfers.

Ripple

Developed in 2012, Ripple is a digital payments technology that processes global payments through its cryptocurrency called XRP, or Ripple, which is now as popular as Ether and Bitcoin. Through RippleNet, its decentralized global network, Ripple enables banks and payment providers to extend funds transfer services without any chargebacks.

XRP’s blockchain-powered technology can process transactions faster and offer more scalability. Ripple reaches consensus between nodes by using the probabilistic voting model.

Ripple has many projects in various deployment stages for customers intending to reduce liquidity costs, enable payment processing across multiple networks, and allow payments across borders.

To improve the speed and security of existing payment processes, notable brands like SBI Holdings, MoneyGram International, American Express, and Deloitte are experimenting with Ripple.

Corda

Released in 2015, Corda is an open-source blockchain platform created by R3, a consortium of leading financial institutions.

By eradicating the monetary impact of business frictions, Corda enables institutions to transact directly with smart contracts.

Unlike Ripple, Corda does not have a cryptocurrency or a built-in token system. It is a permissioned blockchain platform that offers more control over privacy and access to digital records, by restricting permissions across the network and only permitting authorized participants to access the data.

Although initially designed for the financial sector, Corda is also in use across various industries like supply chain, healthcare, and trade finance. Intel and Microsoft are two out of many top firms that have implemented Corda’s blockchain platform.

Trusple

Recently launched by the Ant Group based on their blockchain, Antchain, Trusple is a blockchain platform whose name derives from the words trust made simple.

The platform users can upload their trading orders and generate smart contracts with automatically populated details such as logistics, making the entire process faster and more convenient.

Users can access various marketplaces like AliExpress, and even add multiple vendors who sell to other businesses.

Over the last two years, Ant Group has submitted the highest number of applications for blockchain patents.

Advantages of Blockchain in SCF

Verified Information and Transparency

The distributed ledger technology helps ensures traceability and authenticity of supply chain data and allows different stakeholders to access the same information source. Blockchain technology’s ability to access transparent supplier records and create improved visibility into industry chains helps manage risk within supply chains better. Therefore, buyers obtain verified information about the sustainability attributes of goods purchased along the supply chain, such as provenance, producer or manufacturer involved, production methods used, etc. This solution has great potential to reinforce the transparency of supply chain data.

Diversified Funding

Businesses don’t have to rely on traditional financial institutions anymore since blockchain-enabled supply chains have increased access to a plethora of funding providers. This, in turn, has expanded the gambit of financial services outside that of financial institutions. Now almost anyone from the supply chain finance ecosystem, be it a professional investor, a financial institution, can play a financier’s role.

Reduced Costs

The need for correspondent banks and additional fees is diminished due to the addition of smart contracts. With blockchain technology, suppliers get to have access to working capital solutions through supply chain finance, at a lower cost than in specific local markets. Blockchain technology also helps to clarify the relative relationship between upstream and downstream enterprises within a supply chain and creates a more efficient financial ecosystem.

Going from Analog to Digital

New solutions for supply chain finance challenges will emerge as information continues to populate a blockchain. Information concerning the quality of supplier’s goods and the delivery and payment timeliness has primarily relied on paper between anchor corporations and suppliers since there has not been a way to aggregate supply chain data in an online database. With current disruptive technologies such as blockchain, it is mostly automated and isn’t prone to long wait times and inaccuracies.

The benefits of blockchain-based supply chain finance aren’t just limited to solving a particular enterprise; instead, they can improve the overall industry’s health and all stakeholders within it.

Potential Barriers

While there are many robust arguments to adopting blockchain technology, there are also concerns about ensuring the accuracy and authenticity of data that are recorded on the blockchain at first. Other potential obstacles are likely to include the conflicting needs for transparency and security when sharing information. And of course, agreed standards would be needed if a particular approach were to gain traction across supplier ecosystems.

However, in conclusion, since a blockchain-based platform can run autonomously once deployed, it becomes relatively easier to identify any inaccuracies should they arise—innovations such as this help stabilize various core financing operations while simultaneously driving the industry forward.