SCF is gaining more popularity as a valuable factor in the facilitation and financing of global trade, a highly profitable business worth approximately USD 25 trillion per year, including merchandise and service sector trade.

Around USD 16 trillion, i.e., 80 percent, of merchandise trade is carried out with the help of some form of trade finance, while the service sector grows relentlessly dependent on trade finance. Today, most merchandise trade is facilitated with SCF programs, although roughly 10 percent still uses traditional methods of trade finance such as letters of credit and documentary collections (*ICC Global Trade Survey).

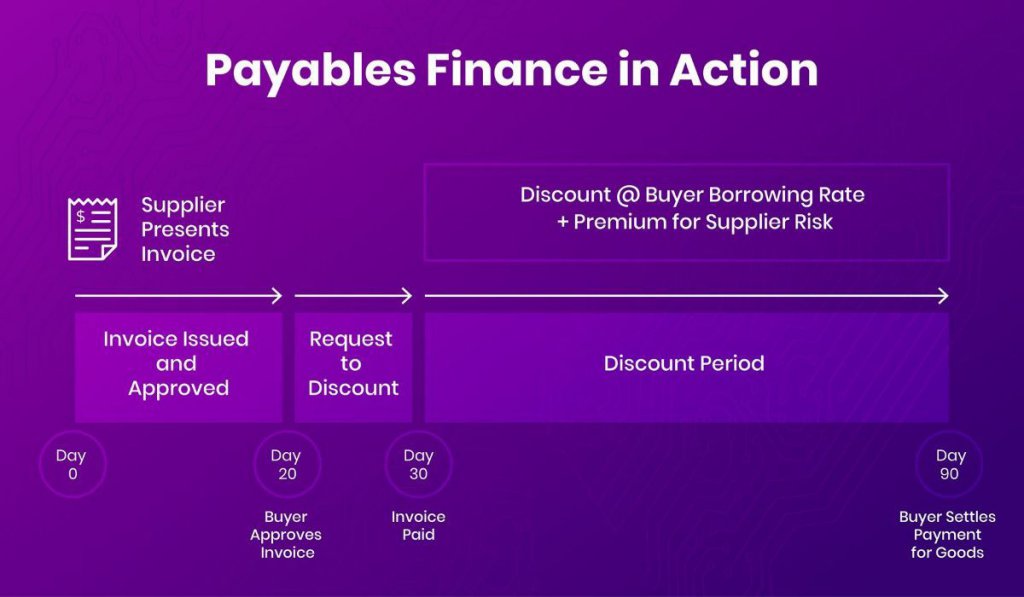

There have been optimistic indications regarding the implementation of SCF on a much larger scale, especially techniques such as payables finance that enable smooth cash flows for both the buying and the selling parties in a cross-national supply chain.

SCF in the APAC Region

Naturally, the outbreak of the pandemic caused a severe impact on the world economy, including supply chains. With the increase in border controls, the movement of goods and services in and out of Asia has slowed down, stated a survey by HSBC. The increased caution in signing up for new orders and the potential delay in payments have both led to a 10-15 percent decrease in transaction sizes. Additionally, many are apprehensive about the challenges that could arise on account of geopolitical issues. Industry participants are also looking to digitize supply chains to tackle the disruptions in global trade now.

The concentration of supply chains in Asia is a lasting affair that will take place over the next few years. The survey by HSBC indicated that participants expected their supply chains to be deeply immersed in the Chinese economy for the next couple of years. These results contradict those under the expectation that China is poised to decouple from the global economy in the near future.

However, the profits expected by other Asian countries are a result of companies leaving China for new markets like Thailand and Vietnam due to more economical labor costs. Additionally, companies have been expanding their operations to various countries so as to curtail their dependency on any specific market. That said, mid- and high-end industries still prefer China over other Asian markets.

With businesses working towards mitigating risks by reducing the number of companies they are involved with, supply chain arrangements will also undergo many changes. Digitized and sustainable practices are also on the rise now, as they are imperative for the success of supply chain management.

Growth of the Digital Age

Fintech companies have taken over the supply chain market with innovative solutions for buyers and suppliers. They offer flexible digital supply chain platforms that facilitate many processes including onboarding, receivables management, and know your customer requirements (KYC), thereby lowering compliance costs. About 90 percent of global banks in the 2020 ICC survey expect a decrease in their cost base with the implementation of digital solutions, apart from which, 77 percent of the total respondents are considering transitioning to a digital model.

Cutting-edge distributed ledger technology, like blockchain, has shown great promise for trade finance and supply chain management. The technology enables participants across the supply chain network to verify transactions and store information in an immutable manner. Since the ledger operates on a decentralized network, it is not owned or regulated by any single member. Smart contracts, which are contracts programmed to self-execute based on the trade agreement, are also an important aspect of blockchain technology for trade.

Sustainability in SCF

Sustainability in SCF refers to the practices and techniques that are employed to diminish the negative impacts of trade transactions and produce environmental, social, and economic advantages for all the parties involved in trade activities.

Today, businesses can create several opportunities by investing in sustainable SCF for the following reasons:

- The SCF market is growing swiftly and is projected to touch USD 10,426.67 billion by the end of 2026, according to research by QYResearch.

- With more and more companies transitioning to digital models, SCF shows an undeniable potential for innovation.

- Since all businesses require working capital for their daily operations, both buyers and suppliers can be incentivized by cash optimization.

- Tracking performance using supplier sustainability data is becoming increasingly easier with improved quantifiability and availability.

- Financial service providers have developed flexible technologies capable of integrating sustainability data.

An increasing number of banks have started realizing the importance of designing sustainability strategies, as indicated by the 2020 ICC Global Survey in which 67 percent of the participants confirmed that they already have one in place. However, there are very few formal guidelines for banks regarding carrying out sustainability in their processes.

Although sustainability practices are still in their infancy, several jurisdictions, including central banks, have made significant advancements in tackling the issues, thus, creating more urgency and complexity in the progress of a global sustainability agenda.

Regulatory Compliance

Concerns about regulatory and compliance procedures in banks continue to rise due to their effects on the potential for growth and the expansion of trade financing capacity. The root cause of these concerns is not the purpose of the regulatory and compliance requirements but the nature and purview of banks in aspects such as:

a.) combating the financing of terrorism (CFT) and anti-money laundering (AML),

b.) inconsistent requirements across different geographies, and

c.) unplanned adverse effects on trade finance due to regulations.

Through teamwork in the industry and support from government bodies for the use of shared KYC libraries and Legal Entity Identifiers (LEIs) in AML and KYC screening processes, banking institutions can match regulatory and compliance standards with less trouble. Such solutions not only enable the validation and verification of data but also minimize the replication of effort and improve objectivity in decision-making.

The complications and expenses arising from compliance could lead to lowered ability in banks to economically support trade. This issue will primarily impact SMEs as they are typically thought to carry more risk and laborious checks but generate the least amount of revenue with each transaction.

How SCF Impacts SMEs

Due to the pandemic and the consequent lockdown, several SMEs in APAC have fought to stay afloat, severely affecting the economic restoration in the region. According to ADB, SMEs make up over 90 percent of the businesses in APAC, covering 50 percent of the labor force. Depending on their development stage, they also contribute to around 50 percent of the GDP in each Asian country (*Asian Development Bank Institute).

With technology introducing new methods for lenders to complete SME verification and onboarding, financing techniques such as factoring and SCF have begun to gain more popularity. According to the 2020 World Factoring Yearbook by BCR, Europe, Asia, and South America recorded the most widespread growth in 2019, with most countries in Asia reporting a sound increase in factoring volumes.

Even in nations where SMEs have, in the past, encountered the most number of challenges to access trade finance are demonstrating a significant growth rate. Thus, SMEs and lenders who wish to offer them financing options can now benefit from more opportunities through the digitalization of trade financing systems.