Fintech companies have reshaped different areas within the banking & financial services industry with their innovative approach. One such segment that has been thriving in the complex world of lending and borrowing is factoring. In Asia, especially, the regional factoring markets have indicated tremendous potential and growth, as stated by the Asian Financial Services Association.

Although factoring as a financing technique is not new, fintechs have been making advances in factoring technology to meet business owners’ needs. Smaller businesses in supply chains would, especially, stand to gain from this form of financing as they frequently face financial strain while waiting to receive payments from their buyers.

In a dynamic market, this delay in payment could impact entire business operations as companies need to ensure that their employees and suppliers are paid on time. Hence, businesses with limited equity capital rely on timely payments from buyers.

To relieve suppliers of this dependency, third-party institutions started introducing factoring as a form of financing. Factoring companies provide intermediary support for businesses looking for liquidity due to delays in payments. As a result, suppliers no longer have to be concerned about limited working capital and disruptive cash flows.

But, first, what is factoring? And what are the benefits for supply chain participants entering into a factoring agreement?

What does factoring mean?

Factoring is a financial service wherein a company sells its accounts receivables to a third party, called ‘factor’ at a discounted rate to meet immediate cash needs. It is often confused with invoice discounting, which is a loan secured against outstanding invoices with the help of invoice factoring companies who directly purchase these unpaid invoices.

Invoice factoring is unlike reverse factoring, as the latter is a financing solution initiated by the buyer to help suppliers finance their receivables.

Factoring is a common financing technique amongst exporters who want to accelerate their cash flow. Through this process, the exporter can draw up to, let’s say, 80 percent of the invoice value during the delivery of goods and the raising of the invoice. Factoring in export-driven economies in the APAC region is bound to gain more popularity as these markets are projected to boost due to the expected 4.5 percent year-on-year rise of the global GDP in 2021 *IHS Markit*

How Does Factoring Work?

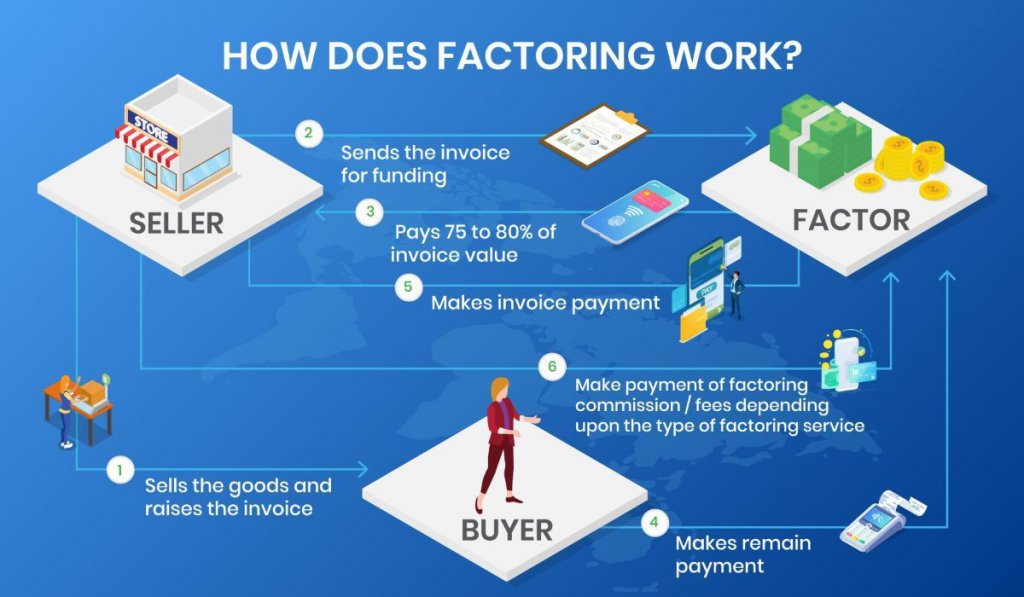

The factoring process starts with the supplier, who sells the goods or services to customers and generates invoices. The supplier then sells these invoices to the factor, who pays a partial sum of the discounted invoice value. Typically, the partially paid amount ranges from 75 to 80 percent of the invoice value after a discount of 2 to 6 percent. Depending on the factoring agreement, the fee or interest charged by the factor may either be upfront or in arrears. After collecting the invoice payments from the supplier’s customers, the factor pays the supplier the remaining 20 to 25 percent.

Types of Factoring

Recourse and Non-Recourse Factoring

Under recourse factoring, the customers’ credit risk remains with the business and not the factor. In this form of factoring, the factor only acts as a financer and collector for the company. As the factoring company does not assume credit risk, the commission charges comprise only a portion of the interest on the money advanced and the collection fee.

Unlike recourse factoring, with non-recourse factoring, the factor bears the customers’ credit risk, so if a customer defaults on a payment, the business is not held responsible. Since the factoring company carries the risk, the commission charged to the business is relatively high.

Advance and Maturity Factoring

As the name suggests, advance factoring refers to the advance payment of money. The business receives the discounted invoice amount soon after the factor takes up the invoice. After the factoring company collects the debt from the customers of the business, it pays the remaining margin.

Some factoring companies primarily offer the benefit of collection services over funding. In maturity factoring, the invoice amount is paid after the customer pays the debt, i.e., on or after the maturity date. Further, since the interest component does not exist in this type of financing, the factoring charges are also low.

Domestic and Cross-Border Factoring

When a factor provides accounts receivables funding, management, and collection services in the domestic location, it is known as domestic factoring. Here, the three parties involved in the agreement, i.e., buyer, seller, and factor, are all located in the same nation.

On the other hand, if these services are provided internationally, it can be called cross-border factoring. Here, there are four parties involved, i.e., importer, exporter, import factor, and export factor.

Disclosed and Undisclosed Factoring

In disclosed factoring, the customer of the business is notified of the factoring agreement, whereas in undisclosed factoring, the customer is not aware of the arrangement. Instead, the payments are made in the name of the business. In such cases, the factor may or may not provide debt collection services, depending on whether it is recourse or non-recourse factoring.

Pros & Cons of Factoring

Pros

- Simple approval process – While lenders in a loan application process typically review personal credit scores, collateral, and overall creditworthiness, factoring offers a much simpler and faster approval process. Small businesses would find it easier to get some quick cash with factoring.

- Easier access to liquidity – Since the application process is quicker and requires less paperwork, smaller businesses can access more money with less hassle. Generally, factoring companies transfer funds through ACH directly into the business’ bank account.

- No collateral requirements – Factoring is a method of unsecured financing, unlike secured loans, and so, companies are not required to offer collateral.

- Transaction of sale – Unlike other forms of funding, factoring is recorded as a sale rather than a loan. As a result, there is no escalation in business liabilities or negative impact on financial ratios.

- Avoid bad debts – Under non-recourse financing, a business can evade bad debts as the factoring company assumes the loss. So, after the business sells its receivables to the factor, it holds no obligations.

Cons

- Higher charges – Factoring enables companies to secure funds faster; however, it comes at a higher fee than other forms of financing.

- Availability – Factoring may not be a suitable option for all business models. For instance, a company that does not use invoices to collect payments would be unable to sell them in exchange for cash.

- Control over collection – When a company owns an outstanding invoice, it can ensure that the customer pays according to their payment terms. However, if the invoices are sold to a factor, this control is relinquished to the third party.

- Decrease in profit – As the factor subtracts a certain amount from the invoice value, and in some cases, charges an interest fee on the advance, the profit margins of the business may reduce significantly.

- Credit reliability – The factor determines the customer’s creditworthiness after a thorough assessment beyond the company’s control. Hence, depending on the credit ratings, the factoring company may be unwilling to extend advances.

Conclusion

Factoring provides entrepreneurs and small businesses with the opportunity to escape financial pressure caused by delayed payments. Therefore, factoring will gain more popularity as a financing technique in proportion to the simplification of the process by fintech companies. Further, financial flexibility is necessary for dynamic and complex markets, making factoring all the more essential for supply chain purposes.