Large multinational corporations are under tremendous pressure to unlock the working capital trapped in their supply chains, especially as these supply chains stretch across the globe with buyers on one side and a group of sellers in different countries on the other.

A McKinsey report in 2015 suggested that SCF had a possible global revenue pool of $20 billion. Supply Chain Finance is a critical process for anyone involved in trade and finance to be familiar with.

However, if you find yourself wondering what it is or needing to brush up on some of its techniques and benefits, this article might be the first of many answers you’re looking for. So let’s start right from the beginning.

WHAT IS SUPPLY CHAIN FINANCE?

What the future holds.

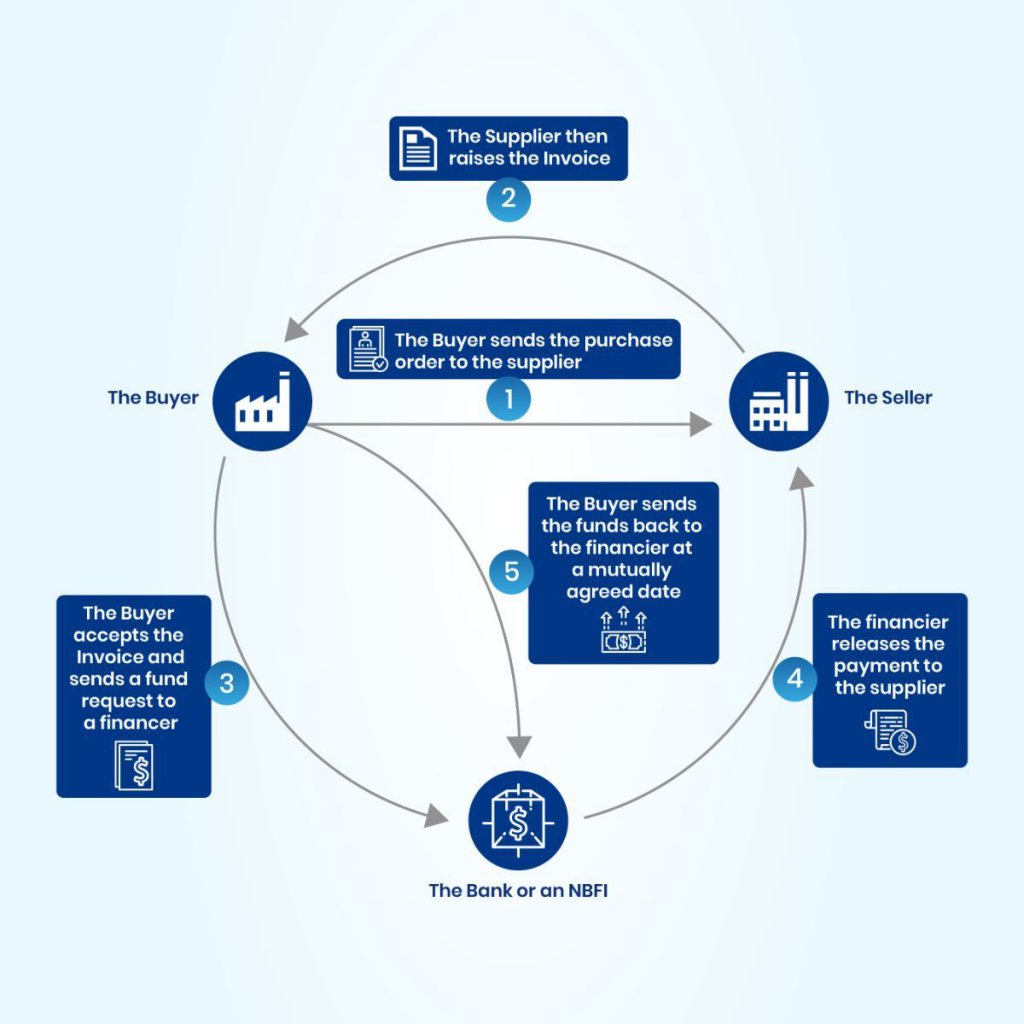

Supply chain finance is designed to lower costs and improve cash flow for both buyers and sellers. Right from initiation to completion, supply chain finance automates invoice approval and settlement processes. Here the buyers approve their suppliers’ invoices for financing by financial institutions.

Supply chain financing optimizes working capital and provides liquidity to both parties in the trade. Both parties, buyers, and suppliers get to free up working capital that’s optimized due to supply chain finance. In doing so, suppliers gain faster access to their owed money, and buyers can pay off their balances at a more convenient pace. This way, the buyers and the sellers can operate smoothly and use the cash on their hands to grow their business or other projects.

SCF works best when buyers who have a better credit score than their sellers can receive capital at lower costs. This helps the sellers get immediate payments, and the buyers get to negotiate extended payment schedules. This process mitigates competition between the seller and the buyer and creates a win-win for both parties.

SCF’s Growth in Popularity

A series of instruments such as traditional trade finances have long financed International trade. However, based on the importers’ and exporters’ preferences to conduct trade on ‘Open Account’ terms, where the goods are delivered before their payment is due, there has been a gradual global shift from such familiar mechanisms.

Emerging markets believe that documentary credit-based trade reflects a lack of faith in those markets has brought about this shift. The movement from traditional bilateral trade arrangements (consisting of one buyer, one seller) to the adoption of genuinely global supply chains, which now include relationships with communities of tens of thousands of suppliers, has also contributed to this change.

Supply Chain Finance has blossomed in the current ecosystem of the complex network of suppliers and open account trade.

Techniques in Supply Chain Finance

Supply chain finance provides several potential solutions to those involved in international trade, all of which have historically developed to serve different markets and client segments:

What are the potential benefits?

The suppliers benefit from access to funding based on the buyer’s credit profile, which often is at a lower cost than what the supplier can obtain on its own. If the supplier accessed financing for these receivables on their own (i.e., factoring as an option), they would likely pay more for that financing than it costs them to participate in a supply chain financing program.

The seller can be paid faster under a supply chain financing arrangement. Even though their invoices are paid at a discount, having the cash earlier enables them to produce more products and increase the sales cycle. Supply Chain Finance also helps the buyers also benefit from extended payment terms.

The buyers also get to reduce their borrowing needs and create a steady decline of interest owed, all while maintaining a great relationship with suppliers. They can also better manage and forecast their working capital for further business growth or new ventures.

What are the potential risks?

While Supply chain financing is available for various market buyers and their suppliers, the middle market buyers may not be able to take full advantage of it as large global distributors. This is mostly the case since the creditworthiness of international distributors overshadows that of the smaller businesses.

This financing method limits various facets such as deductions, setoffs, counterclaims against billed invoices while also requiring negotiation between the buyer and the seller upfront. This must also be weighed against the seller’s quicker payment receipt against the buyer’s longer payment terms.

Summing it Up

Most organizations have not leveraged supply chain finance to its maximum capability. SCF provides many opportunities for buyers and sellers and is also less expensive and more accessible than traditional debt forms.

Various technologies will continue to play an increasingly vital role in delivering SCF solutions between buyers, sellers, and financial institutions to automate the information exchange and integrate the financial supply chains.