As a business starts growing considerably, it begins requiring more funding to expand operations, handle payroll costs, administration, and marketing expenses, among other things. Large or financially stable businesses can often raise their credit with less effort through a bank loan. However, small and medium, or sometimes even large, businesses need a less traditional method to improve their working capital.

Traditional bank loans are not always the right choice for every business — particularly those that require financing as-needed or want to avoid adding to the existing debt in the balance sheet. Bank loans often fall short in their ability to satisfy all the borrowing requirements, leading to more disadvantages than benefits.

On the other hand, factoring is a favorable financing method because it can help you smooth out your liquidity by unlocking the liquidity trapped in your accounts receivables. By considering the invoices as collateral, a company can sell its receivables to a factor in exchange for cash in advance. As your business operations grow, so too does the amount of working capital available to you. Therefore, so long as a company has invoices, it can fund itself through factoring.

Is there a Difference Between Factoring and a Bank Loan?

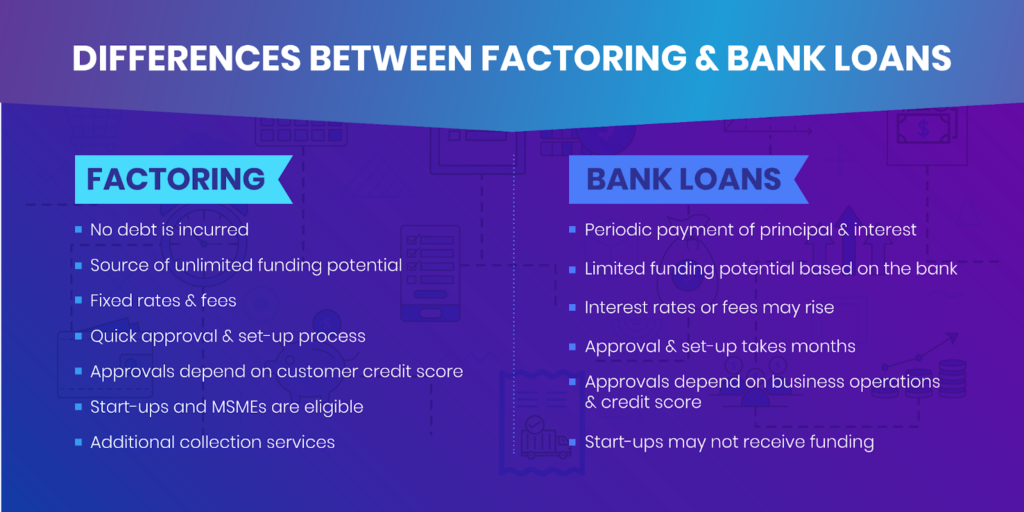

Although some similarities between factoring and bank loans exist, there are key differences that set factoring apart from the latter.

Factoring

- No debt is incurred

- Source of unlimited funding potential

- Fixed rates & fees

- Quick approval & set-up process

- Approvals depend on customer credit score

- Start-ups and MSMEs are eligible

- Additional collection services

Bank Loans

- Periodic payment of principal & interest

- Limited funding potential based on the bank

- Interest rates or fees may rise

- Approval & set-up takes months

- Approvals depend on business operations & credit score

- Start-ups may not receive funding

- No collection or back-office services

Here’s why most businesses prefer Factoring over Bank Loans:

Most small enterprises, especially start-ups, often face a challenge accessing credit for their business operations via bank loans. As the lending standards in the market are usually tight, factoring is a more viable financing method for most corporations.

With bank loans, even if some companies manage to sail through the narrow approval rates, the loan amount may be insufficient for their business needs. Besides, these companies will also need to repay the debt incurred through the loan.

Factoring companies provide approvals based not on the company’s but the customer’s credit history. For companies with bad or no credit, factoring is the most appropriate financing option. Factoring could even offer the kind of financial stability companies need to polish up their credit scores.

Factor funding can be approved and set up within days.

Since the loan approval criteria are stringent, banks often take weeks or even months to review the company’s operations, history, financials, and creditworthiness before processing the request. In contrast, factoring companies can make an approval decision in just a week, if not just a day.

Factoring offers quick funding for companies in need.

With factoring verification completed in just 24 hours, companies can access the advance payment on their discounted invoices within hours of getting approved.

Banks refer loan applicants to factoring companies.

Often, when companies fail to meet the strict lending criteria to be eligible for a loan, they are directed to a factoring company that can help them access funding that banks themselves cannot provide.

Factoring companies open up funding routes for companies of all sizes and business stages by being their financing partner without complicated processes. From newly-established companies to well-established large corporations, factoring enables them to tackle working capital challenges and access credit within a few hours.

How is Factoring Beneficial for Startups & MSMEs?

Start-ups and MSMEs will find that factoring is the better choice due to the approval flexibility. While banks may flag your small business as ‘high-risk’ and reject the loan application or approve a less than ideal amount, factoring is a simpler and more straightforward process that does not depend on a specific credit score or number of years in business.

Generally, a factoring company determines whether an applicant qualifies by evaluating simple factors such as:

- Are the invoices drawn for B2B or B2G services or products delivered?

- Is the debtor or customer in a position to make the invoice payment?

- Does the applying company have a “going concern” or potential bankruptcy issues?

As long as the factoring company can understand these aspects, SMEs will have no trouble meeting the minimum requirements for invoice factoring approval. Small businesses can leverage factoring to increase their cash flow while avoiding debt and outsourcing the collection process.

Some start-ups and SMEs may be hesitant to settle on factoring due to the possible drop in invoice values. However, it is worth noting that factoring is essential for a small business to meet immediate working capital needs and establish a smooth cash flow system to expand its operations.

But, Is Factoring Still a Relevant Financing Option in 2021?

Domestic factoring gained popularity, especially between 2008-2014, when its average volume grew by 6% each year, in 70 countries across Europe, Asia Pacific, the Americas, and Africa. During the same period, the average volume of international factoring increased by 16.6% each year (*Factor Chain International Statistics).

In its 2020 Annual Review, the FCI, a global representative body comprising leading factoring companies, stated that despite moderately weakening towards the end of 2019, the factoring industry performed well overall. While the trends in Europe, Africa, and the Americas inclined upwards, Asia experienced a negative shift of approximately 2%, primarily due to the US-China trade war.

Markets in the APAC region were hit hard by the trade war, and as a result, China imported low volumes of raw materials in 2019. However, despite China’s drop in trade with the US and the EU, its trading opportunities soon shifted towards other developing countries in ASEAN, which became China’s largest trading partner during 2020.

Although there was a slight dip in overall factoring figures in the recent past, the risks associated with world trade have been exacerbated, and the need for factoring is constantly rising each day. A report by Research And Markets on the global factoring industry indicates expected growth of USD 1308.4 billion between 2020-2024, with a CAGR of 7%.

In Conclusion

Factoring offers a debt-free form of financing for companies looking to obtain additional funds without having to bear the burden of a loan on their balance sheets. Unlike traditional financing options like bank loans, factoring offers financing solutions that are flexible and provide tailored opportunities for business growth.