Advancements in technologies for the trade industry have made the ecosystem more efficient and processes more streamlined. Many of the challenges once faced by these trade ecosystems are being solved by technological innovations. It is still a stretch to claim that they have trickled down to every stage in the supply chain. However, the potential for integration is enormous, and with the plethora of solutions these technologies can provide, they play a very crucial role in overcoming many challenges and paving the way toward comprehensive solutions in the trade industry.

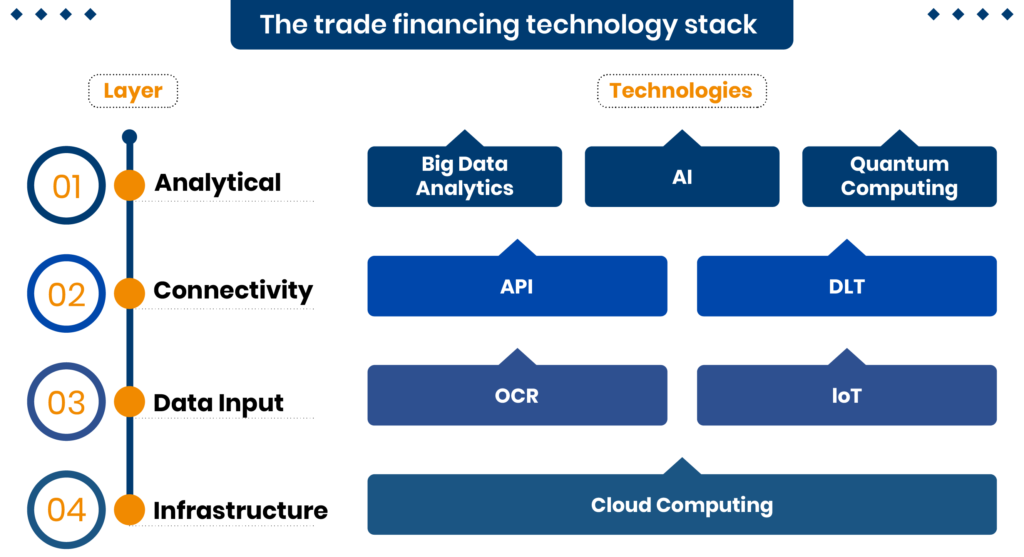

According to the ICC, there are 8 technologies that can be classified into 4 layers of the trade technology framework. Each of these layers comes with the potential to support and improve the adjoining layers. The below article details the potential benefits of the 8 technologies that are digitalizing trade.

1. Infrastructural Layer

Cloud Computing:

According to Microsoft, “cloud computing is the delivery of computing services – including servers, storage, databases, networking, software, analytics and intelligence – over the internet to offer faster innovation, flexible resources and economies of scale”.

Though cloud has matured in other industries, the trade finance industry has just begun applying it in its operations. Since there is no upfront cost on infrastructure, it reduces the investment needed to integrate into the system.

In the context of COVID-19, it has been of utmost importance for businesses to be present on e-commerce platforms. Companies have been able to lower the costs of scalable “pay-as-you-go” models while providing comprehensive security and infrastructural elements. As cloud technology provides a location-agnostic setup, it is beneficial for globally-distributed operations requiring the user to access data from anywhere.

2. Data Input Layer

Optical Character Recognition (OCR):

OCR is a technology that converts scanned or printed text images to a digitally encoded format that can be viewed, edited, searched, and used in other digital processes.

OCR technologies have been instrumental in decluttering, organizing, and widening the access to documents throughout the trade finance industry. Fintech companies enable clients who can’t or won’t deliver the data in a structured format to simply find it from the other side of the world.

The trade industry has 4 billion papers in circulation and an overtime schedule for processing all of them. OCR provides a more straightforward way to reduce the numbers and process more efficiently. It is helping many businesses to transition smoothly from the yesteryears to the digital world.

Internet Of Things (IoT):

IoTs are a network of physical “things” around the world that feed data into the infrastructure by using technologies like sensors, software and hardware to collect and share data in any instance.

In every physical stage of the supply chain, sensors of all kinds will collect and share data with different departments to provide end-to-end visibility. These departments can use the data to avoid errors and make the work more efficient. Additionally, they offer a sense of security for institutions to finance confidently.

IoTs act as oracles for DLT-powered smart contracts to trigger the release of funds quickly. This helps mitigate the back and forth between sellers who want payment before shipment and buyers who wish to ship before payment. They can also transmit information on location, temperature and CO2 levels. These devices provide a comprehensive solution to fraud and inculcate better trust between the trading parties.

3. Connectivity Level

Application Programming Interface (API):

APIs are software intermediaries that allow two applications to interact with each other. Automating the transfer of data helps make the digital infrastructure more efficient. By letting 2 different programs speak with each other, businesses can help realize the full potential of both software.

APIs can be used to overcome customer-centric challenges by providing them instantaneous and transparent access to information about their orders, transactions and shipment details by automating data transfer.

Distributed ledger technology (DLT):

DLTs are platforms that independently store a decentralized, distributed record of transactions. All parties on the network can trust its authenticity while having access from both sides. It promotes transparency and mitigates fraud and legal issues to a large extent.

DLTs also provide a platform for different stakeholders to communicate on a peer-to-peer basis. What Enterprise Resource Planning (ERP) provides to a single enterprise, blockchain provides to the whole supply chain. The crypto-currency revolution has risen from the foundations of the blockchain and is providing a more transparent transfer of funds from one party to another.

4. Analytical Layer

Big Data Analytics:

According to IBM, “big data analytics is the use of advanced analytic techniques against enormous, diverse data sets that include structured, semi-structured, and unstructured data, from different sources, and in different sizes” to uncover hidden patterns, correlations, and other insights.

Data input technologies, such as IoTs and OCRs, produce large volumes of raw data that is primarily unstructured due to a widespread lack of standardization. The analyst’s role is to standardize the data and unravel insights from it. Data input technologies help find patterns and meaning from numbers and statistics. They offer a definitive idea of the way forward for businesses and avoid many losses on that journey.

Artificial Intelligence (AI):

AI is a computer program which has the ability to reason, discover meaning, generalize, or learn from historical experience. Even though the human brain is marvellous and complex, it cannot comprehend such a heavy flow of unorganized data. This is where AI steps in.

Unlike Big Data Analytics, which compiles valuable data for humans to make decisions on, AI can further dive in and find an actual decision. The potential for AI in the trade industry is enormous. They can provide predictive insights across the trade function.

Quantum Computing:

Quantum computing is essentially the process of leveraging and making use of the fascinating laws of quantum mechanics to process data.

While a traditional computer uses long strings of ‘bits,’ which encode either a 0 or a 1, a quantum computer, on the other hand, uses quantum bits, or qubits, which are both 0 and 1 simultaneously. Quantum computers offer great potential to process exponentially more data than classical computers.

This technology is still considered to be in its infancy. Hence, most experts agree that there is currently no strong use case for the trade industry. But it is not a distant future where we see this technology integrated throughout this line of business.

Conclusion

The true potential of digital solutions in the trade industry can be witnessed when there’s a complete integration in the ecosystem. The movement toward integrating digital solutions is an ever-evolving process in itself. New problems will arise during this process, and fintechs will be forced to tweak, change, and improve these technologies. We can rest assured the future is bright and efficient.